Why Is Everyone Obsessed with American Express?

American Express has a magnetic appeal, drawing people in with its exclusive benefits and prestigious status. Find out why Amex is so captivating and what sets it apart from other credit cards.

1. What Art Collectors Will be Eyeing in 2025

2. Her Secret? Knowing What You Don't! How this 45-year-old Profits from Antiques

3. This 200-Year-Old Chocolate Brand Is a Portrait of Switzerland

4. £1 Million When you are ready!

5. Forget the French for a Minute! Take a Bold Journey into Georgian Wine

Subscribe Now!

Two women entered the bar of a 5-star Hotel in Dublin with a sense of elegance. The first, with sleek brown hair and a refined look, wore a black blazer over a white silk blouse and had on stylish loafers. She carried a classic Chanel handbag. Her companion, a redhead with loose waves, donned a deep green dress and high heels, holding a chic Bottega Veneta clutch.

They settled into plush velvet stools at the bar. The redhead, speaking with a clear American accent, ordered, “We’ll have a gin and tonic and a Spritz Aperol.”

The waitress soon returned with their drinks. As the brunette reached for her wallet, she asked, “Can we pay with American Express?”

We noticed the surprise in the waitress’s expression. With a courteous smile, she replied, “Yes, we do accept American Express here.”

Though the question might seem unusual, the fact that American Express cards are not widely accepted for everyday transactions in Ireland is often overlooked. The service industry in Ireland generally favours Visa and Mastercard, with American Express being accepted mainly in high-end establishments that cater to an international clientele.

However, everyone is after Amex because they offer a range of premium cards with extensive rewards programs and travel benefits, catering largely to affluent individuals and business clients.

Unique among card issuers, Amex often functions as both the card issuer and network, which allows it to provide a more controlled and tailored customer experience.

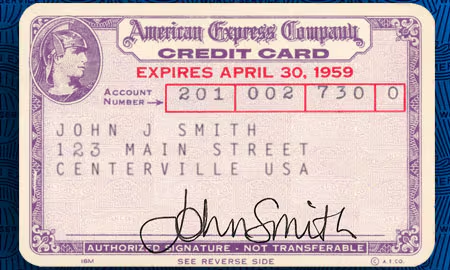

American Express began issuing its first charge cards in 1958, marking a significant shift from its original focus on traveller's checks and express mail services. At that time, American Express was a well-established financial services company with a strong presence in the travel industry. The credit card market was emerging, with early players like Diners Club leading the way.

Seeing an opportunity to leverage its established brand and customer base, American Express launched the American Express Card; a charge card with no preset spending limit.

This card was aimed at affluent individuals and travellers and featured premium benefits such as exclusive travel perks and exceptional customer service. The American Express Card quickly gained popularity for its distinctive offerings and high level of service, playing a pivotal role in shaping the premium credit card market. Over the years, American Express expanded its card portfolio, introducing various products tailored to different customer needs and solidifying its position as a major player in the financial services sector.

As American Express has evolved from its origins in traveller’s checks and charge cards into a major player in the credit card industry, it has continually expanded its offerings to meet diverse customer needs across the globe.

Today, American Express provides a variety of Membership Rewards benefits tailored to different regions, reflecting the brand’s commitment to delivering exceptional value and service. From extensive travel perks to exclusive dining and shopping benefits, these rewards are designed to enhance the experiences of cardholders worldwide.

Here’s a look at how American Express caters to its customers in the United States, the United Kingdom, Australia, Japan, and Singapore.

United States

American Express offers a range of Membership Rewards benefits to fit different spending habits. The Gold Card earns 4x points at U.S. supermarkets and on dining, while the Platinum Card earns 5x points on flights and prepaid hotel bookings through Amex. The Green Card provides 3x points on travel and dining. Points can be redeemed for travel, gift cards, statement credits, or transferred to airline and hotel partners.

Cards also come with travel perks: Platinum Cardholders get access to lounges, annual credits for airline fees, Uber rides, and hotel stays, and Global Entry or TSA PreCheck fees covered every four years. Travel programs like Fine Hotels & Resorts and The Hotel Collection offer benefits such as room upgrades and hotel credits. The Gold Card includes an annual dining credit, while other cards offer Amex Offers for cashback and bonus points. Additional perks include access to exclusive events, a $100 Saks Fifth Avenue credit, and comprehensive insurance protections, with no foreign transaction fees.

United Kingdom

In the UK, American Express offers various Membership Rewards benefits. The Gold Card earns 2x points on dining, travel, and international purchases, while the Platinum Card earns 1.5x points on travel. The Nectar Card converts points into Nectar points for use at retailers. Points can be redeemed for travel, gift cards, or transferred to partners like British Airways Avios.

Platinum Cardholders enjoy access to lounges, travel insurance, and discounts on Eurostar bookings. Dining benefits include early access to event tickets and priority reservations at top restaurants. Shopping perks feature discounts through Amex Offers, purchase and refund protection, and extended warranties.

Additional perks include access to exclusive events, concierge services, and discounts on luxury experiences. Many cards have no foreign transaction fees and offer flexible payment options.

Australia

In Australia, American Express offers varied Membership Rewards benefits. The Platinum Card earns 3x points on dining and travel and 1 point on other purchases, with points transferable to airlines like Qantas, Velocity, and Singapore Airlines. The Gold Card offers 2x points on dining, travel, and international spending, while the Green Card earns 1 point per dollar spent.

Travel perks include lounge access with the Platinum Card, a complimentary domestic flight with the Qantas American Express Ultimate Card, and comprehensive travel insurance. Hotel benefits feature room upgrades and credits through the Fine Hotels & Resorts Program, and car rental perks include coverage and elite status.

Dining benefits include exclusive events, discounts at partner restaurants, and annual dining credits. Shopping protections cover theft, damage, extended warranties, and refunds. Some cards also cover cell phones if the bill is paid with the card.

Additional perks include no foreign transaction fees on premium cards, flexible payment options, business benefits like expense management, and concierge services for travel and reservations.

Japan

In Japan, American Express offers diverse Membership Rewards benefits. The Platinum Card earns 3x points on dining and travel, and 1 point on other purchases, with points redeemable for travel, merchandise, or transferred to partners like ANA, JAL, British Airways, and Singapore Airlines.

Travel perks include access to Centurion and Priority Pass lounges, comprehensive travel insurance, and benefits from the Fine Hotels & Resorts Program, such as room upgrades and daily breakfasts. Premium cardholders also get a travel concierge service and some cards offer complimentary car rental insurance and elite status.

Dining and lifestyle benefits feature the Global Dining Collection for priority reservations and exclusive experiences, plus local offers and discounts at high-end Japanese restaurants. Shopping benefits include retail promotions, purchase protection, extended warranties, and some cell phone protection.

Additional perks include no foreign transaction fees on many premium cards, flexible payment options, and business benefits like expense management tools and higher cashback rates.

Singapore

In Singapore, American Express offers a range of Membership Rewards benefits. The Platinum Card earns 3x points on dining and travel and 1 point on other purchases, with points redeemable for travel, merchandise, or transfer to partners like Singapore Airlines KrisFlyer and Cathay Pacific Asia Miles.

Travel perks for Platinum Cardholders include access to Centurion and Priority Pass lounges, comprehensive travel insurance, and benefits from the Fine Hotels & Resorts Program, such as room upgrades and complimentary breakfast. Some cards also offer car rental insurance and elite status.

Dining and lifestyle benefits include exclusive privileges through the Global Dining Collection, VIP access to events, and curated experiences. Shopping benefits feature Amex Offers with cashback and discounts, purchase protection, extended warranties, and some cell phone protection.

Additional perks include no foreign transaction fees on many premium cards, flexible payment options, and business card benefits like expense management tools and higher cashback rates. Premium cardholders also enjoy concierge services for travel and special requests.

Ireland

In Ireland, while the exact reasons behind American Express’s decision not to issue cards there may not be fully detailed, industry experts and analysts have highlighted several factors. These include American Express’s strategic focus and the unique characteristics of Ireland’s banking landscape.