The Future of Luxury: Trends, Challenges & Opportunities in 2025

The luxury industry faces slower growth and market challenges, yet new opportunities arise through changing consumer preferences and experiential offerings.

The latest Global Luxury Industry Outlook offers crucial insights into the shifting landscape of the luxury sector. Some developments present exciting opportunities, while others pose significant challenges. However, one thing is clear: change is inevitable, even in one of the most insulated categories of consumer goods and services.

Slower Growth Ahead

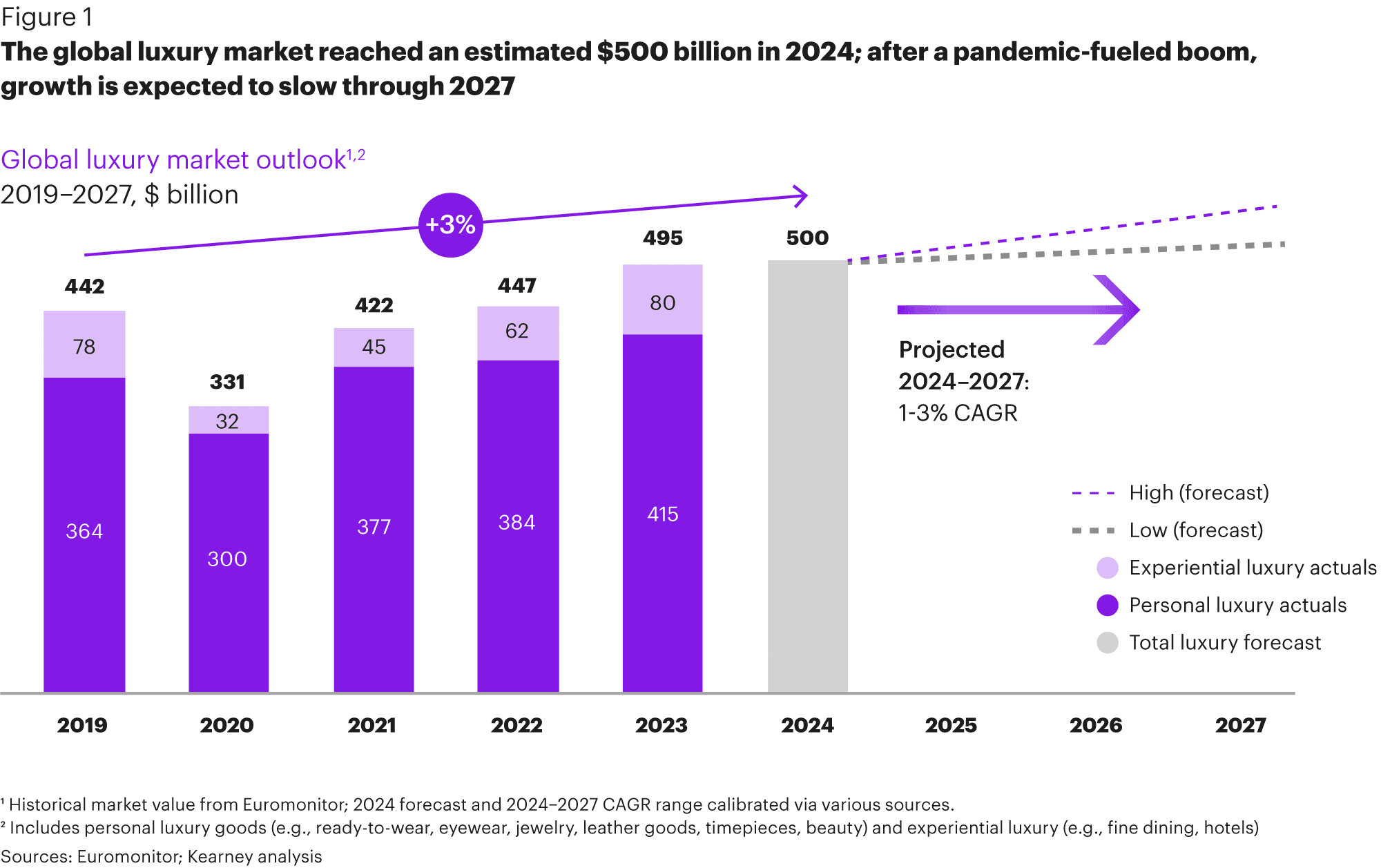

The luxury industry is expected to grow by only 1 to 3 per cent annually until 2027, largely due to persistent inflation and economic difficulties in major markets such as China, the US, and Europe.

Market Challenges

China’s luxury sector is experiencing an uneven recovery, while inflationary pressures and potential trade tensions present uncertainties in the US. These headwinds are reshaping how brands operate in these crucial regions.

Changing Consumer Expectations

With luxury prices at historic highs, consumers are reassessing their spending habits, placing a greater emphasis on value, transparency, and exceptional craftsmanship.

The Evolution of Retail Spaces

Consumers are embracing immersive retail experiences, prompting brands to integrate digital innovations and sensory enhancements into physical stores.

The Rise of Longevity and Wellness

The growing wellness economy offers luxury brands new opportunities to lead through services that focus on health, vitality, and longevity.

A More Diverse Consumer Base

Luxury shoppers are becoming more culturally and demographically diverse. Engaging multiple segments, including Gen Z, Millennials, and aspirational buyers, is crucial for sustained growth.

Strategies for Success

Winning brands are focusing on exclusivity, streamlining operations, and leveraging digital engagement while expanding in high-growth markets.

The Road Ahead for Luxury Brands

As 2025 unfolds, the luxury sector finds itself at a pivotal moment. Following a surge in post-pandemic spending, the industry now faces economic headwinds, shifting consumer preferences, and slowing global expansion. Yet, despite these challenges, new opportunities are emerging.

Experiential luxury categories such as travel and fine dining are gaining momentum as consumers prioritise meaningful experiences over material possessions. At the same time, high-net-worth individuals (HNWIs) continue to drive spending, even amid economic uncertainty.

For brands, the key challenge lies in maintaining relevance while achieving sustainable growth. Critical questions remain: How can brands enhance value propositions? Which strategies will appeal to an increasingly diverse consumer base? How can efficiency be improved without compromising the luxury experience? The way industry leaders answer these questions will shape the future of their brands; and the sector as a whole.

Strategies for Luxury Brands in a Cooling Market

Economic Outlook

The global luxury market is projected to reach approximately $500 billion in 2025. However, after years of strong growth, the pace is expected to slow, with forecasts predicting an annual increase of just 1 to 3 per cent through 2027. Rising inflation and economic uncertainties have led to more cautious spending, particularly in personal luxury goods such as ready-to-wear fashion, leather accessories, and watches. As costs rise, consumers are reassessing their purchasing priorities, leading to increased scrutiny of brand value.

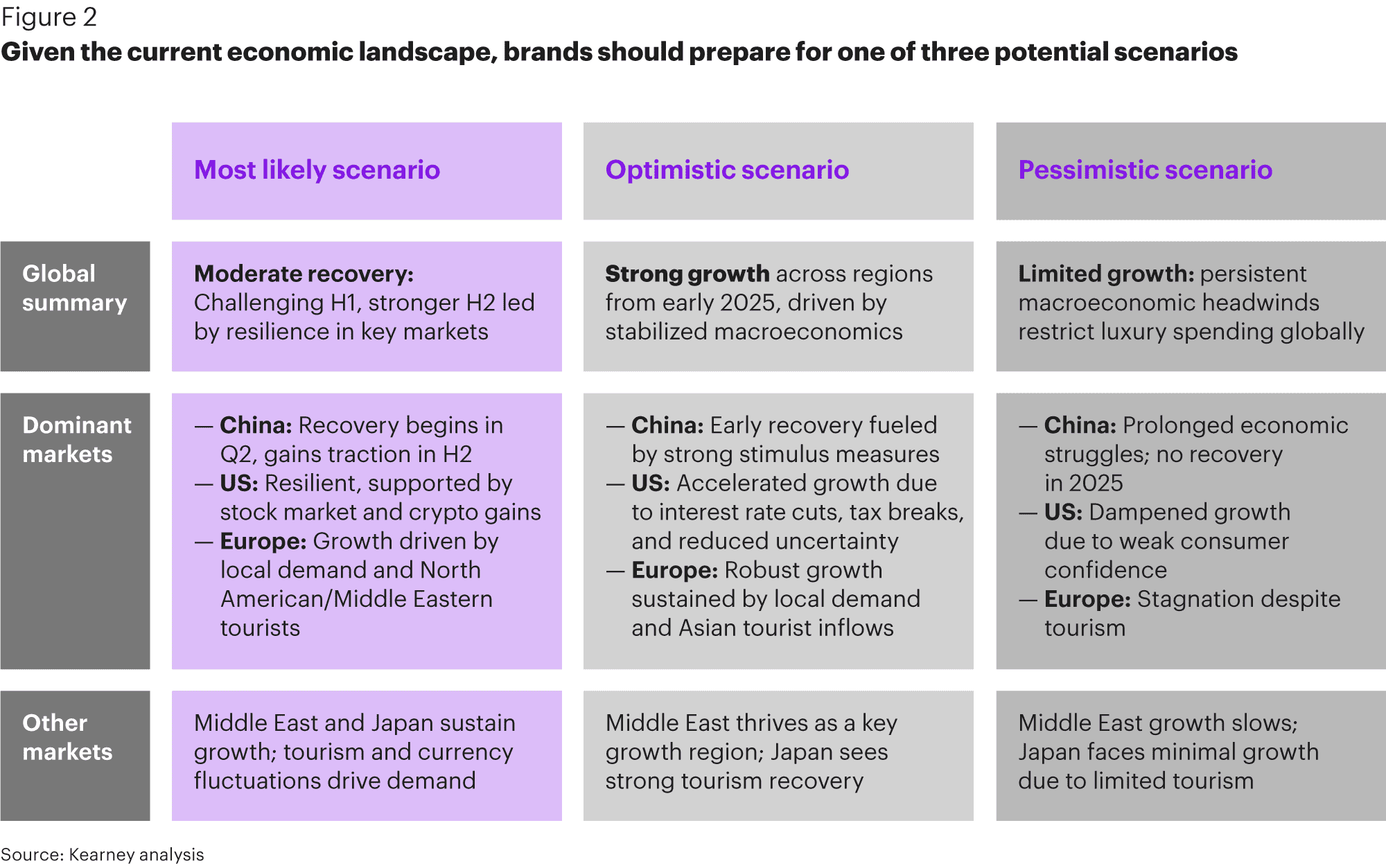

Market challenges remain prominent. China’s recovery is uneven, impacted by low consumer confidence and changing attitudes towards conspicuous consumption. Meanwhile, in the US, inflationary pressures, potential trade restrictions, and policy shifts are creating uncertainty. These factors present additional complexities for luxury brands operating in or sourcing from these regions, forcing them to navigate a highly fragmented and unpredictable landscape.

Personal luxury goods remain the foundation of the market, but experiential luxury is on the rise. Consumers are prioritising travel and fine dining, seeking experiences that offer deeper emotional and cultural connections. Traditional luxury segments, including fashion, watches, and leather goods, are under increasing scrutiny, with shoppers demanding authenticity, superior craftsmanship, and stronger brand narratives.

Brands must be prepared for multiple potential market scenarios. However, one common theme remains: success in the luxury industry will be determined by the evolving expectations of the consumer.

Understanding the Luxury Consumer

Demographic Shifts

Luxury consumers are increasingly diverse across generations and wealth segments. Baby Boomers now represent just 11 per cent of the market, while Gen X (24 per cent) and Millennials (45 per cent) remain the primary drivers of spending. However, ultra-high-net-worth individuals (UHNWIs)—those with over $50 million in assets—continue to play a stabilising role in the market. Despite broader economic fluctuations, their spending habits remain relatively consistent, accounting for approximately a third of all luxury purchases.

The United States leads in terms of UHNWI numbers, with around 110,000 individuals making up 60 per cent of the global total. Meanwhile, emerging markets, including Vietnam, the Philippines, and India, are experiencing rapid growth in wealth, and the UAE is attracting an increasing number of millionaire relocations.

Key Market Trends in 2025

Price Sensitivity and Alternatives

Luxury price increases have outpaced inflation, with some iconic handbags doubling in cost since 2019. While these hikes have benefited brand margins, they have also led to the loss of 50 million customers over the past two years.

As a result, consumers are turning to alternative options. The global resale market has grown significantly, reaching $35 billion in 2024. Meanwhile, the demand for “dupes” and counterfeit goods is rising, as shoppers look for ways to access luxury at lower price points.

Emerging luxury brands and outlet malls are capitalising on this shift, attracting aspirational buyers who seek prestige without excessive mark-ups. To remain competitive, established brands must refine their segmentation strategies, reinforce perceived value, and streamline product assortments to reduce consumer fatigue.

Reinventing the In-Store Experience

Despite digital advancements, physical retail remains essential to the luxury sector. More than three-quarters of luxury shoppers intend to visit stores as often as before—if not more.

To enhance the in-store experience, brands are focusing on:

- Personalised services, such as bespoke products and VIP consultations.

- Digital enhancements like augmented reality (AR) and virtual try-ons.

- Highly trained store associates, offering in-depth brand expertise and AI-powered recommendations.

- Comprehensive aftercare services, reinforcing long-term brand loyalty.

Longevity as a Status Symbol

The global wellness economy is expected to surpass $7 trillion by 2025, and longevity-focused offerings are becoming a key status symbol among affluent consumers. High-value services such as regenerative medicine, advanced skincare, and performance optimisation are gaining traction.

Luxury brands are integrating longevity into their core business models. Hotels near longevity “Blue Zones” are offering exclusive wellness retreats, Michelin-starred restaurants are adopting health-conscious menus, and premium skincare brands are focusing on cellular regeneration.

The Demand for Efficiency

Luxury brands are facing growing cost pressures, including rising raw material costs, labour shortages, and stricter sustainability regulations. To remain profitable, brands must embrace:

- AI-driven supply chain optimisation.

- Sustainable material innovations, such as lab-grown textiles.

- Modular product design for mass customisation.

- Digital tools to enhance efficiency and reduce fraud.

Path to Success

For luxury brands to thrive, they must focus on three core pillars:

- Strengthening brand value through iconic designs, limited editions, and meaningful collaborations.

- Optimising operations by investing in regional craftsmanship, personalisation, and AI-driven efficiencies.

- Preparing for the future by embracing digital transformation, expanding into high-growth regions, and prioritising wellness-focused offerings.

While the luxury market may be cooling, brands that adopt a clear strategy and bold innovation will continue to flourish in this evolving landscape.